shipbuilding

Why generating workforce for the FSS programme will be challenging

Around 1,000 new workers will need to be recruited at two UK shipyards in order to fulfil the build for the Fleet Solid Support programme, a challenge according to UK officials. Richard Thomas reports.

Image: copyright

A

As with many heavy industries in the UK, shipbuilding and ship repair capabilities slipped by the wayside from the middle period of the 20th Century as the country’s economy attempted to recover from the impact of significant economic and social shocks through war and market depressions.

By the turn of the millennium, shipyards with storied histories in the sector ceased to build, or else scaled back their maritime efforts as to fade into a near irrelevance.

These pressures, coupled with the competition from overseas rivals able to either leverage subsidised contracts from national governments that saw the value in heavy industry, or else able to utilise huge amounts of lower-paid labour, rapidly scooped up market shares that the UK in generations before had considered part of the national fabric.

In a bid to revitalise UK shipbuilding, the 2017 Sir John Parker’s National Shipbuilding Strategy (NSS) was an attempt to set the conditions to renew the country’s maritime sector and ensure it was able to avoid the boom-and-bust tendency experienced as the Royal Navy periodically needed to renew its surface assets.

Refreshed at the end of Q1 2022, the NSS would see £4bn of UK Government investment into the sector in order to support shipyards and suppliers across the UK, in theory providing access to finance, skill and training, and other developmental areas in commercial areas such as offshore wind and green energies.

As stated in the UK Government release at the time, the NSS refresh, designed in partnership with industry and delivered by the recently formed National Shipbuilding Office, would deliver a pipeline of more than 150 new naval and civil vessels for the UK Government and Devolved Administrations over the next 30 years. This included warships, Border Force cutters, lighthouse vessels, and the planned National Flagship.

In 2022, the UK Government stated that the shipbuilding sector supported 42,600 jobs across the UK and contributed £2.8bn to the economy in 2020.

Speaking at the announcement of the NSS refresh, the then Prime Minister Boris Johnson said: “Shipbuilding has been in our blood for centuries and I want to ensure it remains at the heart of British industry of generations to come.”

Flagship sunk without sailing

However, the much-maligned National Flagship, whose use had been questioned in an era of tight budgets, was axed in Q4 2022 as the need for new maritime security capabilities came to light in the wake of the Nord Stream 1 pipeline sabotage.

Instead, the expected £250m investment would be directed into the Multi-Role Ocean Surveillance Ship (MROSS) project, is a pragmatic decision to focus on delivering critical near-term capability at the expense of long-term shipbuilding investment.

In an announcement on 7 November, UK Secretary of State for Defence Ben Wallace revealed the plan to accelerate the introduction of the MROSS vessels at the expense of the National Flagship, with the first in class expected to be handed over in 2023. The first MROSS vessel, acquired direct from the commercial sector, headed to Cammell Laird shipyard in Birkenhead for conversion for use by the Royal Fleet Auxiliary (RFA).

The move follows an earlier speech in October 2022 where Wallace revealed the intention to procure a multi-role research vessel from the commercial sector, which would be refitted with defence equipment in the UK before entering service sometime in 2023. A second vessel will be built in the UK, offering an olive branch to a UK shipbuilding sector deprived – no matter the lack of utility of the planned National Flagship – of much-needed work.

For an industry keen to maintain the recent uptick in naval shipbuilding orders, the loss of the Flagship programme will have been unwelcome for companies such as Harland and Wolff, which was a likely contender for the manufacture of the vessel. Other non-defence prime shipbuilders, like Cammell Laird, had also put forward their readiness to undertake the programme.

Rear Admiral Rex Cox, CEO of the National Shipbuilding Office, in a 7 November 2022 statement, said: “The National Flagship project showcased the talent of the UK’s maritime industry, and I am grateful to all those bidders who took part.

“The willingness to embrace modern design and production practices with a focus on green innovation embodies the essence of the National Shipbuilding Strategy refresh. This contemporary approach to shipbuilding and design will be fundamental to the success of the future shipbuilding pipeline.”

Regenerating the workforce

Another significant challenge for UK shipbuilding, aside from the fluctuating fortunes of defence investment and the limited requirement for commercial shipbuilding in the country, was that, should a contract be awarded to an in-country site, much of the workforce had been drawn down after decades of neglect and lack of opportunity.

In a poignant example of the shrinkage of the UK shipbuilding capability, in 2013 BAE Systems ceased the manufacture of warships at Portsmouth Naval Base, bringing to a close 500 years of industrial history at the site. Reasoned as a necessary move in order to sustain shipyards on the River Clyde in Scotland, it nevertheless highlighted a shrinking need for shipbuilding capacity and the UK Government’s political requirements at the time.

Across the country, shipbuilding, outside of that required for the manufacture of naval vessel, was losing out to overseas sites. Even the aforementioned RFA, a civilian-operated arm of the Royal Navy, saw its Tide-class fleet tankers build by DSME in South Korea, before sailing to Cammell Laird for fitting out of key subsystems. The Tide class, ironically, was eventually delivered late, and over budget.

Where success has been achieved, such as the recent win for Harland and Wolff as part of an RFA need for new logistics vessels under the Fleet Solid Support Ship (FSS) programme at its Belfast and Devon (Appledore) sites, workforce generation has been explicitly stated as being one of the main challenges.

In January this year, the UK Ministry of Defence (MoD) awarded a £1.6bn contract to Team Resolute, comprised of UK ship designers BMT, UK shipyard Harland & Wolff (Belfast and Appledore), with Navantia UK, an arm of Spanish shipbuilder Navantia, acting as prime contractor. Under the terms of the deal, the consortium would deliver three FSS ships to the RFA by 2032.

The new vessels are being constructed to replace RFA Fort Victoria, a three-decade old sole-ship class that offers capabilities of both stores ship and fleet tanker. Once delivered, FSS ships will be deployed to support carrier and amphibious task groups by transporting ammunition, spare parts, food, and other equipment to deployed UK naval assets.

Around £77m from the total contract amount will be invested for infrastructure upliftment at Harland & Wolff’s shipyards in Belfast and Appledore in the UK, which would create around 900 jobs alone at the Belfast facility.

The contract also marks the rebirth of shipbuilding activities in Belfast, where blocks and modules for FSS fleet will be built and final integration of combat systems carried out. An as-yet undetermined proportion of the block builds will also be undertaken at Navantia’s Cadiz shipyard in Spain.

At the time of the FSS announcement, it was expected that production work would commence in 2025, with UK yard recapitalisation and enhancements expected to begin immediately.

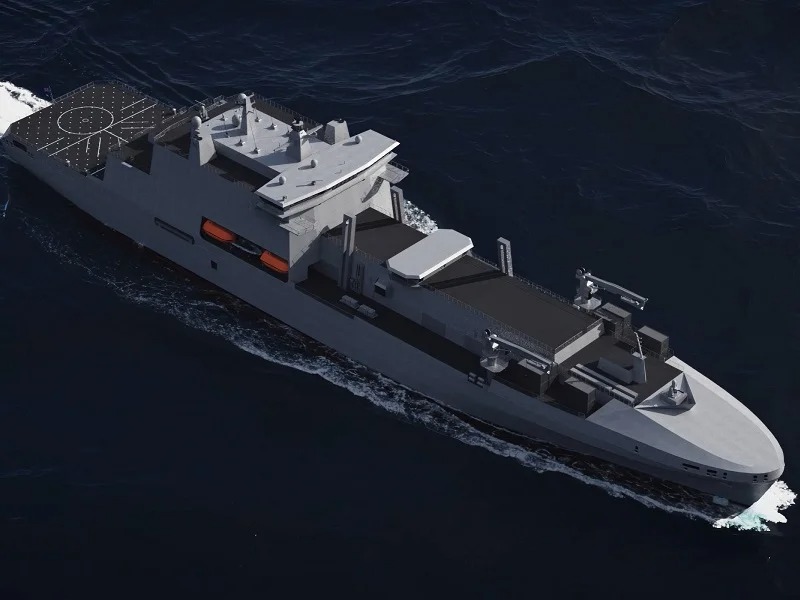

The FSS will act as a supply ship for deployed UK carrier strike groups as well as other Royal Navy or allied vessels operating around the world. Credit: BMT

However, during scrutiny of the FSS programme in the House of Commons Defence Committee annual shipbuilding report session on 31 January, Royal Navy officials disclosed that generating an expected 1,200-strong workforce in Belfast, up from approximately 100 at the time of the contract award, would be a difficult undertaking.

Vice Admiral Paul Marshall, the senior responsible officer of the FSS programme at the UK MoD, said the “mobilisation” of a 1,200-strong workforce was highlighted as a “key risk” from the outset.

“It is going to be challenging,” said Marshall, adding that it was not an “unnecessary risk” as there was “risk in any complex procurement”.

To achieve this, newly recruited workers at Harland & Wolff will travel to Cadiz for training, before returning to the Belfast and Appledore sites to begin FSS block construction. Trainers from Navantia would also be present at UK sites helping to continue to train and assist UK block manufacture.

Both the Harland & Wolff Belfast and Appledore sites were acquired by maritime engineering company Infrastrata in 2019 and 2020 respectively. Babcock, the previous owners of Appledore shipyard, closed the site in 2019, while Harland & Wolff’s Belfast site had long since ceased marine vessel manufacture.

Doubts were also raised during the committee session as to the decision to award a £1.6bn contract to Team Resolute, of which Navantia created its Navantia UK subsidiary in May 2022 to “reinforce [the company’s] commitment to its UK industrial partners” in the shipbuilding and offshore wind energy sector. The UK manufacturing element of the programme will be heavily reliant on the expertise of Navantia’s Cadiz workforce until the Belfast and Appledore sites are able to operate independently.

With around two years before the start of production work for the FSS vessels, and some workforce training packages acknowledged during the committee hearing as taking a year or more to complete, the ability for the programme to either remain on track or retain its key UK workshare will be dependent on the successful completion of the shipyard recruitment package.

On 1 February Harland & Wolff announced that it had formally signed the manufacturing subcontract with Navantia UK in relation to the £1.6bn FSS warship programme. Under the terms of the subcontract, Harland & Wolff will be responsible for delivering works worth around £700m to £800m through the life of the programme.

What of the competition?

Rival FSS bids from UK shipbuilding primes Babcock and BAE Systems, Merseyside-based shipyard Cammell Laird, and international OEM Larsen and Toubro, were not taken forward after the final bid submission.

Babcock is currently building the new Type 31 frigates for the RN at its site in Rosyth, with an expected five ship class to be delivered by 2028. The IOC for the first in class HMS Venturer, which will be floated out in 2023, is not due before 2027 at the earliest.

Meanwhile, BAE Systems is building eight Type 26 anti-submarine warfare frigates at its Clyde shipyards, although the programme has been delayed and will now only see the first in class HMS Glasgow achieve an in-service date of Q4 2028, with sea trials due to begin in 2024 before an extensive capability insertion and testing period.

The final Type 26 frigate is due to be delivered to the RN by 2035, in time for the final Type 23 frigate, HMS St Albans, to be removed from service.

Despite losing out on the FSS programme, Cammell Laird works extensively with the UK MoD having previously outfitted the earlier-mentioned Tide-class fleet tankers and is also undertaking the Power Improvement Project (PIP) of the Type 45 air defence destroyers, which will see the integration of new diesel generators into the ship’s hull to offset propulsion difficulties as a result of the Type 45’s electric drive configuration.

The PIP is due to complete by 2028, with HMS Dauntless the first in class to complete the process and due to return to Portsmouth this month to begin re-entry to the fleet.

In a rare moment of civil shipbuilding success, Cammell Laird also built the new Antarctic survey ship for the UK National Environment Research Council, with the vessel undertaking its inaugural mission in 2020.

However, with the vessel (named the RSS Sir David Attenborough despite a national poll opting for the more humorous ‘Boaty McBoatface’) expected to be in service for more than 20 years, a key element of the NSS would be to ensure that any gaps would be able to be filled with other UK requirements, such as UK Border Force vessels or other civil marine shipping needs.

Success is not guaranteed

More than five years after first being published, Parker’s NSS remains a document that was intended to offer a roadmap for the UK to renew its shipbuilding sector but, to date, has only achieved incomplete success.

Despite the promise of work for yards in Belfast and Devon under the FSS endeavour, it remains a sticking point that Navantia’s Cadiz site will provide the majority of the shipbuilding expertise and no little percentage of the block builds.

Other sites such Cammell Laird and A&P Group in Falmouth, despite a run of sustainment contracts for RFA and RN vessels, could still go years without undertaking complex vessel manufacture in the commercial or military sectors.

While the chance of resurrection has been offered through the NSS, it is by no means guaranteed that the UK shipbuilding sector will be able to take advantage of the promised resources.

Persistent competition from overseas rivals, and the possibility of changing political winds or requirements, leaves it ever vulnerable to the same peaks and troughs that did such damage in generations past.