UKRAINE CRISIS BRIEFING

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 6 May

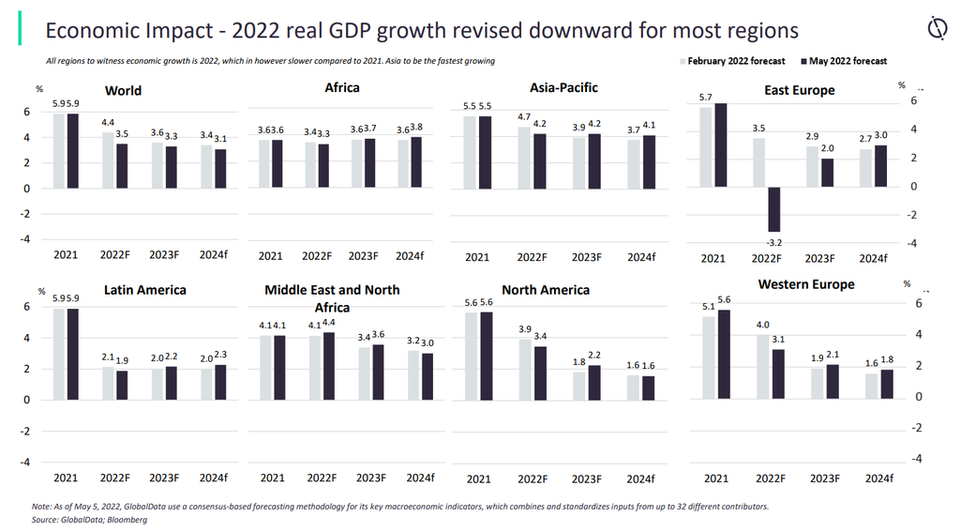

GlobalData forecasts that the world economy will grow at a slower pace of 3.5% in 2022 following a 5.9% growth in 2021. Global inflation is projected to rise to 6.5% in 2022 from 3.5% in the previous year due to supply chain disruption.

Real GDP growth for Asia-Pacific has been revised down by 0.5 percentage points (pp), East Europe by 6.7pp, West Europe by 0.9pp and North America by 0.5pp in May 2022 compared to January 2022 projections.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 6 May

Key Travel And Tourism developments

Revenue impact

Wizz Air slashed its growth target in March after stopping the sale of flights to and from Russia and Ukraine. Wizz Air is the only EU carrier to have a base in Ukraine. The company’s four aircraft stationed there will be withdrawn pending a “safe evacuation window” for them. It previously operated 45 routes out of Ukraine and was the second-largest budget airline in the country with a 27% market share, according to the company’s 2021 annual report.

In late April, Eurocontrol, the European organization for the safety of air navigation, noted that oil had spiked to $152 a barrel. The organisation stated that many airlines were not viable with oil at $100 a barrel. Airlines that have not hedged their fuel needs could end up in a precarious situation. Increased fuel costs mean higher ticket prices for travellers, which could deter many price-sensitive consumers from flying

In Cyprus, Russian visitation accounted for 6% of total inbound trips within the top 10 inbound source markets. Although this percentage is not overwhelming, it makes Russia an important source market for Cyprus. According to GlobalData’s Q3 2021 Consumer Survey, 61% of Russians stated that they typically undertake sun and beach trips, which means Russians will especially be missed by Cyprus’ popular coastal regions, impacting the revenues of many businesses connected to the travel and tourism industry in these areas, such as all-inclusive hotels in Limassol.

SANCTIONS

The sanctions implemented since the invasion of Ukraine have left Russia isolated, as its airlines are still unable to fly to much of the world and are barred from receiving new planes.

Many non-Russian airlines are having to take diversions to avoid flying through Russian airspace. Closed airspace translates to longer flight times, increased fuel usage, more pilot hours, higher costs, and consequently higher fares. Higher fares could further impact the recovery of many airlines with global operations.

As Russian tourists stopped flying to Greece, Turkish Airlines made the decision to divert the lucrative Russian source market to Turkey. In early April, Turkish Airlines signed an agreement to bring 1.5 million Russian tourists to Turkey in 2022.

DEMAND DISRUPTION

Ukraine and Russia are important source markets for Turkey. In 2021, they created a combined 4.9 million visits to Turkey, which was 36% of the total visits from its top 10 inbound source markets. Turkey will be heavily impacted by the crisis.

Italy and Cyprus have been popular destinations for Russian tourists. However, with the EU banning Russian aircraft from operating in its airspace, these nations will be receiving hardly any Russian tourists this summer. Both countries were in the top five most visited nations by Russians in 2021, and so they will feel the economic pinch of a fall in Russian tourists.