Coronavirus (Covid-19) Executive Briefing

Understanding the economic impact of the Covid-19 pandemic and the implications for the travel and tourism sector

- ECONOMIC IMPACT -

GlobalData polls show oncern over the spread of Covid-19 remains volatile while business optimism remains high.

The World Economic Forum estimates advanced economies will shrink by 7% and emerging and developing economies will contract by 2.5% in 2020. (3 August)

7.1% + 7.8%

In June, unemployment in the EU27 and Euro Area rose to 7.1% and 7.8% respectively, compared to 6.6% and 7.5% in June 2019. (3 August)

1.8 million

1.8 million jobs were restored in the US with unemployment rate declining to 10.2% in July against its peak of 15% in April. (7 August)

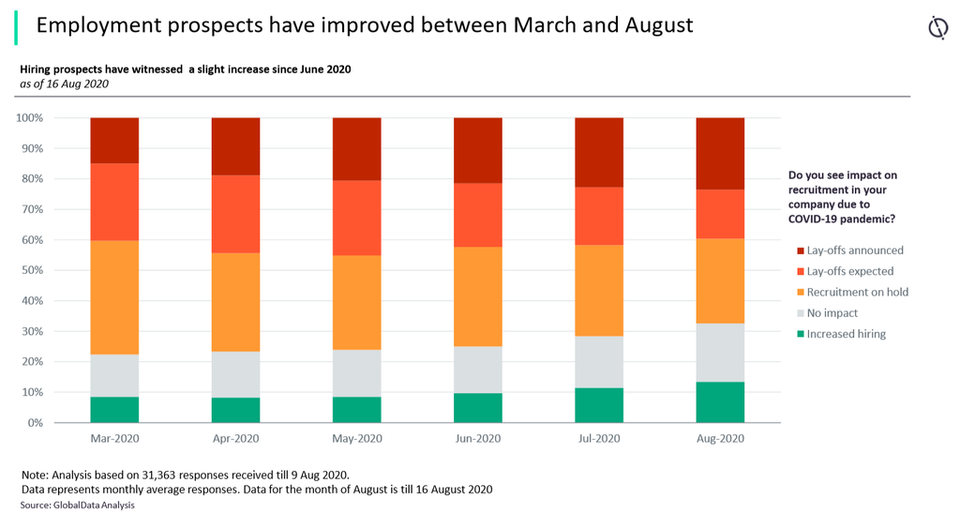

Impact of Covid-19 on Employment

- SECTOR IMPACT: TRAVEL AND TOURISM -

As of 18 August 2020

International Arrivals

-34.5%

GlobalData forecasts that international arrivals into the 62 largest tourism markets globally will fall by 34.5% in 2020.

Inbound tourist spending

-37.9%

Spending will fall broadly in line with the decline in tourism flows. GlobalData forecasts that inbound expenditure globally will fall by 37.9% in 2020. Domestic tourist expenditure is expected to fare better, with a projected decline of 27.3%.

impact on transport infrastructure

$2.03bn

Royal Caribbean's results show just how hard hit the cruise industry has been. Compared to Q1 2019, revenues fell 16.7% to $2.03bn. The company's operating loss was $1.3bn, compared to a profit of $1.3bn in 2019. Q2 will likely be far worse due to the suspension of sailings.

Travel industry developments

The travel and tourism industry is hoping for a marked improvement in the second half of the year and there are some encouraging signs.

The UK has established a series of air bridges with other European nations, making short trips viable. Air bridge talks in other parts of the world, most notably between New Zealand and Australia, are at an advanced stage too.

Airlines are now increasing their flight schedules, both domestically and internationally to create demand during the busy summer months. However, the number of flights operated remains well below pre-Covid levels and many airlines are warning of significant job cuts, with United saying that 36,000 employees could be furloughed from 1 October because of the slump in passenger demand.

The recent surge in new cases in some US states could see a reintroduction of travel bans and New York state has now imposed quarantine requirements on visitors entering from 19 states.

Southwest and Delta are operating with reduced capacity on board to implement social distancing and Royal Caribbean has extended suspensions of sailings for three of its brands until October, showing the struggle that lies ahead.

Lufthansa announced on 25 May that it will receive €9bn ($9.7bn) from the German government. The deal, which was approved by shareholders on June 25, will see the government take a 20% stake in the firm.