Shipbuilding

Mega-mergers:

how will new shipyard goliaths in Asia shape competition?

The recent merger between China’s two largest shipbuilders is triggering competition concerns as similar deals are currently on the cards for neighbours South Korea and Japan. How are these Asian mega-mergers stacking against each other, and how could they change the shipbuilding market? Adele Berti finds out.

Image: Steve Heap / Shutterstock.com

Just before the turn

of the decade, China announced the completion of the merger between its two largest shipbuilders – China Shipbuilding Industry (CSSC) and China State Shipbuilding (CSIC) – into the state-owned China Shipbuilding Group (CSG).

The move is not too surprising. Over the past ten years, Beijing has been consolidating its grip over a number of sectors, including agriculture, the railways and power generation. China’s long dominance in the shipbuilding industry is so far only second to South Korea, whose two biggest shipyards – Hyundai Heavy Industries (HHI) and Daewoo Shipbuilding & Marine Engineering (DSME) – are also planning a merger.

Following behind these countries is Japan, a one-time industry leader that is now the third-largest shipbuilder in the world, and which is - non-coincidentally - also looking to combine its two biggest champions.

Although currently at three different stages of their mergers (so far only China has finalised the deal), these unions are already giving competitors a fresh new headache. In particular, if South Korea’s transaction goes to plan, the resulting company and its Chinese counterpart will together handle almost 45% of global ship orders.

Experts claim that the impact of such dominance may well not be seen in the short term, but in the long term, there is little doubt on the power it will put in the hands of only two countries.

A reinvigorated fight for the top spot

China, Japan and South Korea have been dictating the rules in the shipbuilding sector for several decades, having gradually attracted clients from Europe since the 1960s.

Over the last 20 years, however, Beijing and Seoul-based companies have managed to outclass their Japanese counterparts in most segments of the sector, with China topping the order book between 2012 and 2018, and then losing ground to South Korea in the last two years.

Tighter competition and decreasing demand have pushed countries to specialise themselves in different sectors

Tighter competition and decreasing demand have over time pushed both countries to specialise themselves in different sectors; Chinese companies gradually expanded their portfolio of warships and merchant ships while South Korean competitors focused on sustainability and building more complex vessels.

It should therefore come as no surprise that when HHI and DSME announced plans to merge in a deal valued at a mammoth $2bn, China was quick to respond. Months after the March 2019 announcement, Beijing officials approved the union of CCSC and CSIC (which had previously been split in 1999) into the now consolidated CSG.

Image: VesselsValue

Image:

Breaking down the mergers’ future market potential

Now that the deal has been completed, it could be only a matter of time until South Korea’s two champions come together. Their merger is currently pending the green light from Japan, Singapore, China, Kazakhstan and the European Union.

In the meantime, concerns have grown in the sector, as many fear competition will be significantly reduced if the deal is approved.

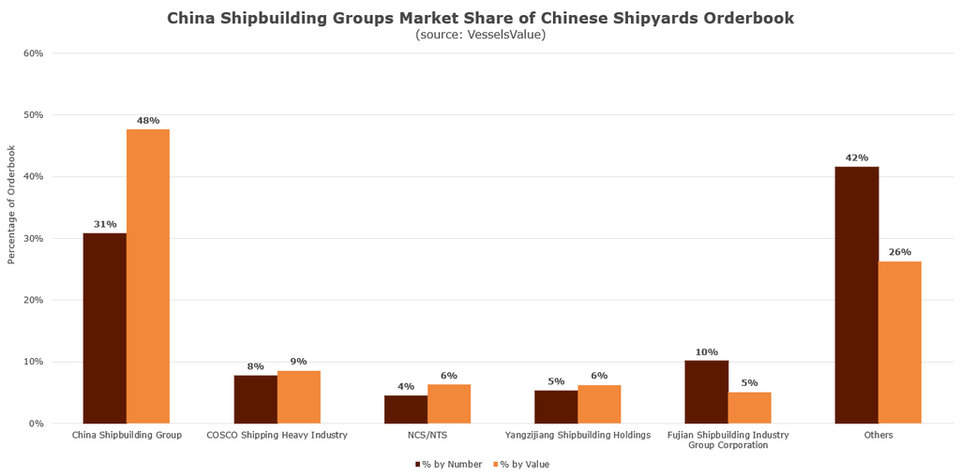

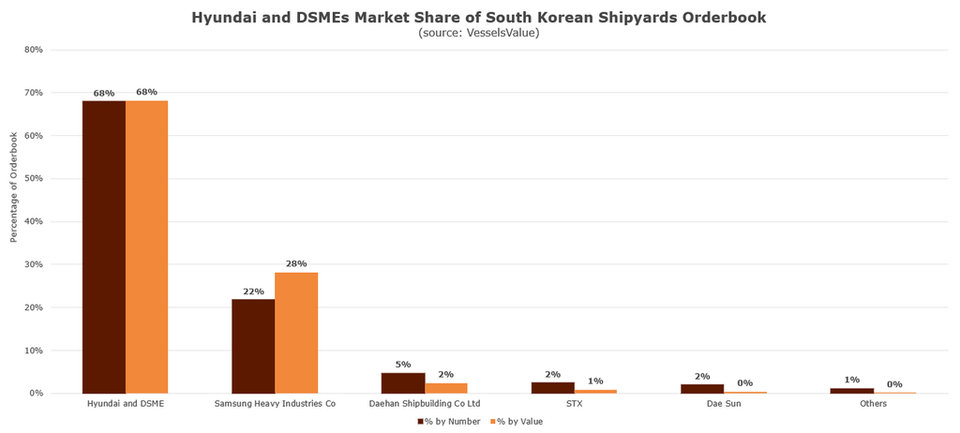

Indeed, figures from market intelligence service VesselsValue show that HHI and DSME would have a combined order book worth $34.5bn, with some 327 ships currently under construction. Although fewer in number than CSG’s order book, which has 411 vessels, these orders are greater in value; orders for the Chinese shipbuilder are currently worth $21bn.

Korea and China have in practice segmented the market between them

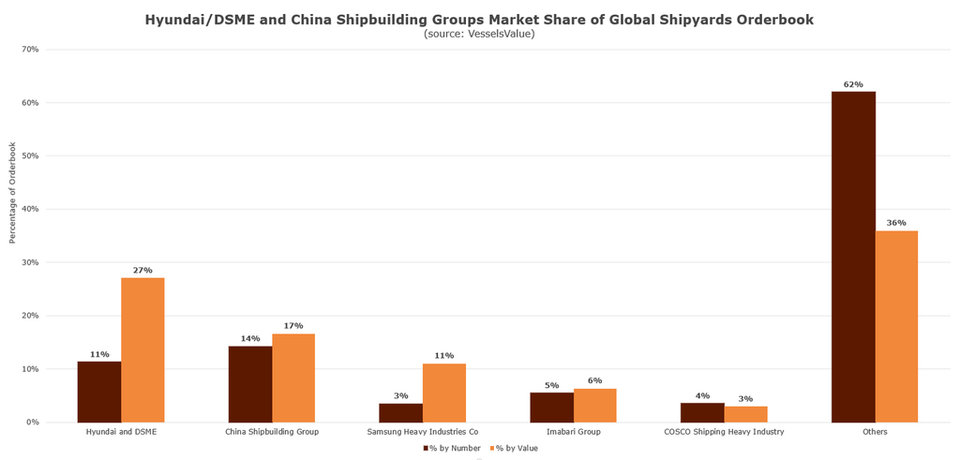

Yet above all, the industry is disapproving of the combined force these two mergers could have in the future. “Both entities have hundreds of vessels currently being built, worth tens of billions of US dollars,” explains VesselsValue spokesperson Sam Tucker. “Looking at this from a global perspective, 25% of all new vessels are being built in these locations, which represents 44% of the value of the entire order book.”

This means that the two could potentially divide orders between themselves, annihilating competition in several divisions. “Korea and China have in practice segmented the market between them, whether intended or not,” says Arnulf Hagen, adjunct professor at the Norwegian University of Science and Technology’s (NTNU) Department of Marine Technology.

In addition, according to Navin Kumar, director of shipping consultancy Drewry’s Maritime Research division, both mergers account for almost one fifth of the global order book each. This is particularly significant when looking at their respective areas of expertise. “While the Chinese shipyards are known for their dry bulk, container and naval ships,” he adds, “the Korean yards have the reputation of building more sophisticated vessels such as liquefied natural gas (LNG) carriers, liquefied petroleum gas (LPG) carriers, floating storage regasification units (FSRUs), chemical tankers, containers and naval warships.”

Image: VesselsValue

Long-term impacts

While holding their breath until the Korean merger is completed, global shipbuilders will find little consolation in the fact that it will take time before market dynamics are effectively altered.

This is mainly due to the slowdown in demand that has been hitting shipyards around the world since the 2008 financial crisis. “Today, the supply exceeds demand and we have a buyers’ market,” says NTNU’s Arnulf Hagen. “But before the financial crisis the situation was the opposite, a sellers’ market.” In addition, Drewry’s Navin Kumar asserts that with over 2,000 operational shipyards around the world there are “too many yards in the fray to have an immediate impact on newbuilding prices immediately, […] but the impact of consolidation will be felt when demand for new ships gathers momentum”.

Yet according to Hagen, things could change if/when the market returns to pre-financial crisis standards, something that the two mergers could help facilitate if they set similar prices to those of the early 2000s. “Should such a situation return,” he explains, “these merged companies will have a very strong hand on the pricing and also, through their significant buying power, have a strong grip on the maritime suppliers."

The impact of consolidation will be felt when demand for new ships gathers momentum

For the moment, however, it might still be a while before a similar situation appears. This is not only due to the fact that the HHI-DSME deal is far from being approved but also in light of the ongoing Coronavirus outbreak that is spreading throughout Asia and beyond.

A global health emergency since January, Covid19 Virus has at the time of writing claimed more than 2,000 victims with over 60,000 cases registered in China alone, where it originated.

Faced with the sudden spread of the disease, Chinese shipyards have been looking at measures to alleviate the damage, closing several shipyards and operating others at limited capacity. “We are working at around a quarter of our capacity,” an executive from CSIC told the Wall Street Journal earlier in February. “The supply chain for some yards has been seriously impacted. Spares aren’t being delivered and engineers are still at home.”

Although no official comment on the virus has come from South Korean shipbuilders, they are likely to be less impacted by it. Nevertheless, HHI’s sister company Hyundai Motor, which traditionally imports several components from China, recently announced the closure of one of its biggest facilities due to the outbreak. The factory is located in the Ulsand area, where HHI’s shipyard – the largest in the world – can be found. Whether or not the facility also risks closure has not been disclosed at the time of writing.

Image: VesselsValue

How are competitors reacting to the mergers?

Sooner or later, the industry should start preparing to see more country-based consolidation deals take place. “These are challenging times for shipbuilding, newbuilding prices are low, new orders have dried up,” explains Kumar. “Margins have grown thinner and many yards are struggling to stay afloat. Many proposals are on the drawing board. We should not be surprised if we see more of them.”

After all, he continues, these initiatives are not a new phenomenon in shipbuilding. “In 2012, a number of Japanese shipyards came together to form Japan Marine United,” he says. “With four of the biggest shipyards on their way to become two, Japanese shipyards will be under pressure to consolidate.”

Indeed, Japan did not waste any time and in November last year, Japan Marine United and compatriot Imabari Group announced plans to form an alliance. According to VesselsValue data, Imabari controls about 5% of the global shipyards’ order book by the number of orders and 6% by their value. The union would be responsible for an estimated 10% of the international shipbuilding business.

Such a reaction is hardly alone, says Rahul Kapoor, vice president at information provider IHS Markit, who adds: “In a challenging environment for shipyards and to be a globally competitive supplier, a super yard is the only way forward.”

With four of the biggest shipyards on their way to becoming two, Japanese shipyards will be under pressure to consolidate

A vocal opponent is Singapore, which recently launched an in-depth review of the HHI-DSME deal. “The parties are currently two of the largest suppliers for the global supply of LNG carriers, and possibly large container ships and large oil tankers,” the Competition and Consumer Commission of Singapore said in November 2019. “There are concerns that the proposed transaction will remove competition between two main suppliers of these commercial vessels, to the detriment of customers in Singapore.”

Yet Kapoor believes this probably won’t be the only reaction we’ll get from Singapore. “It is not at all surprising that Singapore is reacting to the consolidation taking place in yards in South Korea and China,” he says. “A combination of Singapore yards is certainly on the cards in the not-so-distant future.”

As for the remaining portion of competitors, the European Union is also currently undertaking an in-depth investigation into the merger on the grounds of reduced opportunities in cargo shipbuilding.

Nevertheless, the NTNU’s Arnulf Hagen says: “European yards have long been outcompeted in the market for bulkers, tankers, and container ships, mainly now producing cruise vessels, ferries, as well as fishing vessels and specialised vessels for the offshore industry and renewable energy sector.”

Order numbers are therefore unlikely to be significantly damaged by the mergers, but they are still likely to affect prices in the coming years. “Prices of shipbuilding steel are far lower in Asia than in Europe, partly a reason for the decline of the steel-intensive shipbuilding in Europe and this benefit may in time trickle over into other segments making these yards also competitive in the cruise market, a business Asian yards still haven't penetrated,” he concludes.