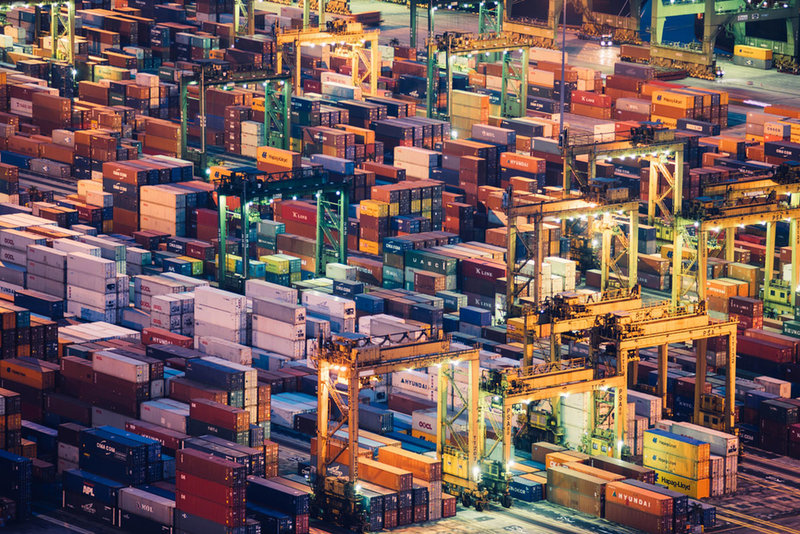

CARGO

Global shipping container shortage: the story so far

The global shortage of shipping containers, primarily caused by the Covid-19 pandemic, has led to drastic inflation in shipping and container prices and increased delay times for companies. Frankie Youd asks why shipping is facing this container shortage and how it is having a global impact.

Freight shipping has found itself in a unique situation where unforeseen events have caused a global shortage of containers, which has had a domino effect down the supply chain, disrupting global trade.

Early last year, when the Covid-19 pandemic began to spread, many countries implemented national lockdowns and ceased the production of goods, which ultimately pulled the plug on economic growth.

Shipping companies began reducing the number of cargo ships that were being sent out. This not only stopped the usual flow of import and export, but also saw empty containers lying uncollected on docks.

The most significant example of this can be seen in the American regions, where Asian containers could not be sent back due to Covid-19 restrictions.

As countries started to grapple with Covid-19, China – the first country to be impacted by the disease – began to recover. Ultimately, this meant China was able to resume its import and export trade while other countries were unable to.

Why is the industry facing this shortage?

So where have the containers vanished to? A significant number of containers have found themselves in inland depots while others have been stacking up at cargo ports.

As Asia slowly began to recover, other countries were still faced with national lockdown restrictions meaning containers could not be sent back to Asia, where they were needed to continue the trade partnership. The pairing of lockdown regulations alongside other factors, such as a staff deficit, meant a backlog of containers began to develop.

We are desperately looking for more capacity.

The Covid-19 pandemic has resulted in a shift in customer spending away from services to goods. This resulted in the issue of container shortage becoming even more prominent as desirability increased, which left many companies being unable to secure sufficient quantities of containers.

Asides from the impacts of Covid-19 disturbing the usual flow of trade and container availability, another major factor was the Chinese New Year. Celebrated on 12 February, the holiday played a bigger part than normal when it came to container shortage.

Generally, the industry can expect to see an increase in container tariffs and a slowdown of Chinese production due to most of the population being on holiday. This year, the impact was greatly magnified due to the ongoing container shortage.

Global industry giants thrown off balance

Many shipping industry giants, such as Maersk and Hapag-Lloyd, have been hit hard by the global container shortage, which has resulted in them adapting their methods and facing shipping setbacks.

Hapag-Lloyd has thought outside the box when it comes to adapting its containers for alternative uses, and increased refilling and emptying times to 25% faster than usual to ensure optimal efficiency.

Turning the reefer containers off allows dry goods such as shoes, electronics, or textiles to be sent to reefer demand locations. Once there, they can be emptied and switched back on to continue their journey.

We think that we need closer cooperation between customers, shipping lines and port terminals.

Alongside these methods, Hapag-Lloyd has considered reusing older containers to cope with the increasing demand, as the company’s senior director of corporate communication Nils Haupt explains.

“We are desperately looking for more capacity,” he says. “We are asking our customers to return empty containers earlier. We looked at containers that are currently in repair or ones which are meant to be sold because they have reached a certain age. This is something we are not doing right now because we would rather use those containers we have a bit longer, but it something we have looked into.”

With the situation being unprecedented and ever shifting, Haupt stresses the importance of close industry collaboration to prevent situations like this from occurring again.

“The shipping industry is very volatile,” he adds. “We think [that] we need a closer cooperation between customers, shipping lines and port terminals so we can be better prepared for situations like this in the future.”

Impact of container shortage on the UK

In the UK, companies such as Hexstone have been impacted when it comes to shipping goods and receiving product from the Far East.

Ian Doherty, CEO of Hexstone Group, and vice-chairman of the British and Irish Association of Fastener Distributors, speaks about Hexstone having a stock of product – normally holding between four or five months’ worth in the UK – to minimise the disruption that issues like this can cause. However, the company has still been affected.

“We have goods that we are unable to ship because we haven’t been able to get containers,” says Doherty. “We've had delays of anything up to six to eight weeks where we've had product ready to go but unable to get to the Far East. It’s a real impact. I don't think we've had a single boat dock on time. We are constantly having containers put back.”

I don't think we've had a single boat dock on time.

Aside from the container shortage, importers in the UK and Ireland are facing additional charges and longer wait times.

Continuous delays at ports such as Felixstowe – the UK’s busiest container port, which deals with 48% of Britain’s containerised trade – has resulted in a backlog of product waiting to be delivered, which increases the time the container takes to move on to its next destination.

Congestion at the port has been going on for several months, which has led certain cargo ships to drop containers at Northern European ports to avoid delays. This typically adds a further two weeks to lead times, adding further pressure on container availability.

Shipping costs have also inflated due to the port delays. “The congestion at Felixstowe is affecting shipping costs because shipping lines are adding congestion charges coming to UK ports,” adds Doherty. “Congestion of the ports has been a big issue for us.”

Port of Felixstowe.

Solving the container shortage

With no one in the industry having a crystal ball to predict the future for this issue, methods have been put in place to assist companies globally, such as the creation of a new booking system.

Alibaba Group’s Cainiao has launched its own container booking service, which can be used for air and sea freight in response to the global shortage of containers. This service will span more than 200 ports in 50 countries and aims to reduce the backlog of empty containers.

Maersk, the largest container shipping line and vessel operator in the world, has been significantly affected by the container shortage but believes that the current situation will soon improve.

Moving forward, transparency in rule-making globally is key for all market players to support global trade.

Lars Mikael Jensen, head of network and market east-west at Maersk, says: “It is expected that the situation will improve. Bottlenecks are expected to be relieved, buying patterns likely to normalise, and additional vessels and containers will enter the market in 2021.

"This means that the current vessel and container shortage is temporary in nature. Moving forward, transparency in rule-making globally is key for all market players to support global trade.”

The global shortage and impacts of Covid-19 have left the industry in uncertain waters. However, container availability is gradually increasing while congestion is reducing in certain bottlenecks. As the year progresses, the industry hopes to see improvement on the horizon.